Point of Care Revenue Surpassed $1 Billion in 2024 — What’s Driving the Surge

ArticlesTuesday Aug 12, 2025

A Milestone Moment in Healthcare Marketing

In 2024, the Point of Care (POC) industry demonstrated strong growth: total revenue among Point of Care Marketing Association (POCMA) members alone exceeded $1 billion, —a robust 16% increase over 2023’s revenue of $870 million*. Because POCMA members represent only a portion of the POC market, the actual total industry revenue is likely higher.

“As Linda Ruschau, Chief Commercial Officer at PatientPoint, explains: ‘Point of Care delivers the 2 critical components for pharma marketing success, a doctor and a patient — at the moment diagnosis and treatment decisions are made. No other channel offers this level of access or proximity to the point of script. After 30 years advocating for the intrinsic value of reaching the right audience at the right moment, it’s rewarding to see Point of Care being recognized as a foundational channel to any marketing plan.”

But what’s driving this growth in Point of Care? And what does this mean for how pharmaceutical marketers should plan their media mix going forward into 2026? We’ll explore the benefits of POC that are making brands take note.

For readers newer to Point of Care, this postoffers a clear overview of how the channel works and why it matters.

The Trend: An Evolving Healthcare Marketing Media Mix

The growth of the POC channel underscores a broader shift in how and where healthcare marketers engage key audiences: POC is no longer a niche tactic—it’s emerging as a focal point in healthcare media planning.

For years, many marketers treated Point of Care as a nice to have channel—a last tactic layered onto campaigns already in motion. That mindset is shifting. Leading healthcare marketers are now building campaigns from the Point of Care outward, recognizing that the most effective healthcare marketing doesn’t interrupt the care experience—it enhances it.

This evolution is driven by the simple reality that POC places brands directly in the decision-making moment. Traditional channels often rely on chance — hoping patients recall a TV spot during an office visit, or that digital targeting captures the right person at the right time.

But POC marketing removes the guesswork. By delivering messaging where healthcare actually happens — exam rooms, waiting rooms, hospitals, pharmacies, telehealth sessions, and clinical platforms — marketers can position their messaging in trusted, context-rich environments.

2024’s POC revenue passing the $1 billion mark builds on a longer trend of accelerated growth for the channel. Between 2019 and 2023, POC spending among reporting POCMA members grew by 171%, reaching approximately $803 million—a compound annual growth rate (CAGR) of around 22% per year. At the same time, direct-to-consumer (DTC) ad spend in pharma rose 26%, while HCP-targeted media declined 22%.

The Drivers: What’s Fueling the POC Boom

POC Marketing Sits at the Intersection of Context, Credibility & Trust

Messaging at the Point of Care engages patients when health is top of mind and when patients are in the mindset to heed recommendations.

"Consumers today are increasingly taking a more proactive approach to their healthcare, focusing on preventative care versus sick care. As such, they are spending more time in the places in which they receive care – whether that be a traditional doctor’s office, an urgent care, pharmacy, or other. POC gives brands the opportunity to reach and connect with patients in these environments, when they are seeking solutions and support, and arms clinicians with information as they are engaging with and providing care to their patients.”

Sandy Weag

EVP, Engagement Strategy & Communications Planning

CMI Media Group

POC marketing occurs where consumers are actively seeking information – among top 10 health information sources, patients rank POC just below HCPs (Doctors, Nurse/PAs, Pharmacists) and before other channels like health information websites, health-related publications or search engine results.

POC marketing also takes place where healthcare decisions happen—in doctor’s offices, clinics, pharmacies, and via telehealth. That proximity to care engenders credibility – Healthcare providers are the most trusted source for health information. And in a time where trust in health reporting is declining, POC leverages authority from HCPs to drive recommendations.

"The Point of Care channel represents a transformative opportunity in our holistic media strategy, spanning both front office and back office touchpoints. It's where we can reach patients, caregivers, and healthcare professionals at the most critical moment, when treatment decisions are being made. This channel allows BMS to deliver meaningful brand messaging precisely when it matters most in the patient journey. Rather than hoping our message reaches the right audience at the right time, Point of Care ensures we're present during those pivotal conversations between patients and their care teams."

Naveed Patel

Executive Director, Worldwide Media Planning & Buying Excellence

Bristol Myers Squibb

82% of patients value health information at their doctor’s office or hospital, illustrating the effectiveness of perceived medically-endorsed content. This positions POC messaging as inherently more credible than other forms of advertising.

And amid the evolving regulatory landscape —especially around pharmaceutical communication—POC’s in-context, provider-validated approach provides a stable, trusted alternative for effective healthcare marketing.

POC Delivers Messaging Audiences Trust

When patients exposed to POC ranked health information channels by effectiveness, POC materials came out on top for trust: In-office materials (74%), Health websites (56%), Television (31%), Social media (15%). This preference for POC should prompt a rethink of channel mix.

Mark Awdeh, President of CheckedUp adds, ““Point of Care marketing has a unique advantage in that it reaches patients and caregivers during moments of heightened attention and receptivity, when healthcare decisions are being actively considered. Unlike broader media channels, Point of Care delivers messaging in a trusted, clinically relevant context, often reinforcing conversations between patients and HCPs. This immediate proximity to the decision making process can make messaging more impactful and much better retained.”

And unlike in open digital environments—where ads risk appearing alongside misinformation or irrelevant content—POC media shows up in closed, professionally curated networks, and only in clinical settings. This controlled context preserves both patient trust and brand reputation.

Brands See Strong Results from Audiences Exposed to POC Marketing

This trust works. In one analysis, adding POC to digital or TV campaigns boosted total prescriptions (TRx) by 6–8%—a clear indicator that credibility drives conversion.

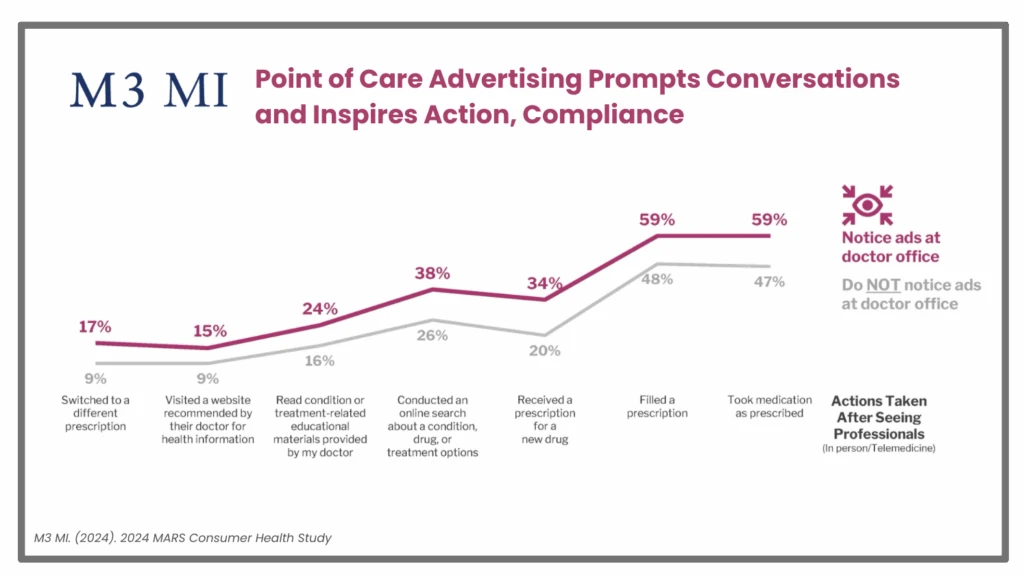

And while many channels promise engagement, research documents that POC catalyzes behaviors that directly impact brand success:

- For instance, 58% of patients and caregivers who encountered a pharmaceutical ad in-office reported that it made them more knowledgeable about their medications—a 12% increase from previous years.

- Patients exposed to ads at POC are more likely to take/refill prescriptions than those who saw them on TV.

- 60% felt more empowered to take action.

- 42% of patients saw a healthcare ad in the doctor’s office within the last year. And among those who saw a healthcare ad in this setting, 58% of patients or caregivers were willing to discuss the advertised treatment with their doctor.

“We had a brand that needed to achieve double digit growth. So we needed to change the way we thought about targeting and shift our typical go-to-market approach. We used POC to reach patients that were harder to get on therapy, and saw huge growth in volume of incremental new patient starts as a result, as well as a 56% reduction in cost per incremental new patient starts.

Elizabeth Dexter

Vice President

Point of Care, Publicis Health Media

Marketers Benefit From Precision Targeting at the Point of Care, Enhanced by Digital Integration

POC marketing has also proven to be effective not only for its context and trusted nature, but because POC targeting capabilities are also evolving to enable more sophisticated, bespoke interactions that yield better outcomes.

These precise targeting capabilities can ensure resources and messaging make their way into the right hands, whether reaching patients or healthcare providers. And while POC has always offered targeting capabilities within the context of physical spaces – like practice location, patient demographics served by a given practice and so on – the proliferation of digital media at the point of care means that POC media is evolving to offer more targeted ways to reach your audience..

Digital integration—through portals, screens, electronic health records (EHRs), kiosks, and telehealth—makes POC more precise, responsive, and scalable. Digital POC can reach patients regardless of geography, enabling brands to reach audiences by diagnosis, care stage, or treatment code—all while maintaining patient privacy.

Patients Benefit From Increased Education at the Point of Care

In an era where launching a new therapy can cost upward of $2 billion, POC marketing plays a critical role in connecting patients with the right therapies at scale. POC helps align the “5 Rs” (right product, right patient, right time, right place, right price) by delivering education, support, and affordability messaging exactly when patients and providers need it.

Lindsay Bosslett, Vice President, Editor in Chief at Health Monitor said, “A lot of Point of Care is also focused on simply enhancing the patient and healthcare provider relationship—it’s a tool to create better, more informed conversations. Those are inevitably going to lead to better health outcomes—in fact, a study published in Federal Practitioner found improved doctor and patient conversations reduced both hospitalizations and incidents of death for patients—which further validates Point of Care materials as reliable and helpful resources that are worth trusting.”

POC can play a significant role in allaying fears about medicine and healthcare, while also encouraging patient participation in their own care. Research shows a strong emotional benefit tied to POC exposure, with patients reporting greater clarity and confidence:

- 80% of patients report that POC education increases care satisfaction

- 83% of POC-exposed patients feel reassured about their healthcare direction (vs. 76% unexposed)

- 81% feel relieved about having clear next steps (vs. 72% unexposed)

For these reasons, POC media helps strategies reach underserved audiences and dismantle barriers to treatment. “Brad Royer, Chief Product Officer at Office Ally says, ‘The best place to receive help is from a trusted caregiver at the point of care. Tailored messages to specific diagnoses at the point of care build trust and improve the patient, provider relationship.”

As healthcare marketing becomes more competitive and complex, POC stands out as a channel that consistently delivers where it matters most—right place, right time, right message. Its ability to merge trust, precision targeting, and educational messaging for patients and HCPs is a cornerstone for the next era of healthcare engagement. And with digital integration unlocking even greater personalization and scale, the impact of POC is only set to grow.

For marketers and brands looking ahead, the question isn’t whether to invest in POC—it’s how to harness its full potential in the years to come.

Looking Ahead to 2026: The Next Chapter of POC Marketing

So what does this mean for POC and for the brands that leverage it in 2026?

Continued Revenue Expansion – Given POC’s revenue growth trajectory—from $870 million in 2023 to over $1 billion in 2024—we can expect further growth in the coming years.

An Ongoing Emphasis on Trust & Brand Safety – Part of what has inspired better outcomes at the Point of Care is its trusted context. Messaging appears only in clinical settings where patients are actively engaged in their care. Going forward, healthcare marketers will continue to lean into POC’s trust advantage and POC’s closed-loop, brand-safe offering to ensure the reliability and efficacy of their POC investment.

Digital Diversification – POC continues to scale beyond waiting rooms into telehealth, portals, AI-driven targeting, and wearable health tech. And with this scale comes more opportunity for brands to personalize creative to meet audiences at different touchpoints throughout the care journey. Brands that master these cross-context transitions—and create unique content for each touchpoint—will successfully engage HCPs, patients and caregivers.

Increased Efficiency – Technological advancements and the channel’s evolving targeting capabilities will result in POC campaigns delivering unmatched efficiency. With digital integration into EHRs, patient portals, and telehealth platforms, campaigns will deliver diagnosis-specific messaging, care-stage targeting, and treatment-code precision—all while maintaining HIPAA compliance. These innovations preserve the credibility of the POC environment while enabling greater personalization, geographic reach, and measurable outcomes.

Refining Measurement and Integration – As the industry discusses how to adopt standardized measurement frameworks for Point of Care, marketers will gain deeper insights on how to best leverage POC media. This will allow teams to optimize spend, strategy, and format selection more dynamically.

Equity & Access as Core Strategy – POC holds unique power to address health disparities. Going forward, equity-focused deployment—ensuring resources reach underserved patients in rural, language-diverse, or high-need communities—will be both an ethical imperative and a strategic advantage.

POC: Now a Core Channel in Your Marketing Mix

POC revenue surpassing $1 billion in 2024 marks a turning point: POC is no longer auxiliary, but foundational. With its profound trust advantage, measurable outcomes, evolving formats, and equity-aligned impact, POC is shifting from a mere campaign tactic to strategic priority and advantage for marketers and brands alike.

For media planners, agencies, and pharmaceutical marketing leaders: the question isn’t if POC belongs in your strategy – it’s how prominently you should feature POC. Let this milestone be your cue to invest in POC as a cornerstone of your 2026 plans.

Ready to take the next step? Marketers looking to deepen their expertise can explorePoint of Care Academy—POCMA’s on-demand micro-learning platform designed for healthcare marketers.

*Revenue Collection Methodology

This analysis is based on voluntary revenue reporting from POCMA member organizations:

- Survey Coverage: Revenue data was requested from 25 member organizations (POC media companies), where 23 members provided responses.

- Response Rate: 98% of the 2024 data collected included actual revenue figures; 2% of the total spend was based on projected revenue.

- Conservative Estimates: Report prepared based on voluntary member revenue reporting, with all figures representing calendar year performance. Total industry spend is likely significantly higher when accounting for non-participating organizations and market segments not represented in current membership.